Medicare Parts C and D plan sponsors play a crucial role in administering these essential healthcare programs for seniors and individuals with disabilities. As we delve into the complexities of their responsibilities, financial management, and quality assurance measures, we gain a deeper understanding of the intricate landscape of Medicare Part C and D plan sponsorship.

From ensuring plan compliance with Medicare regulations to providing comprehensive member services, plan sponsors are the backbone of these programs. Their innovative approaches and commitment to quality improvement shape the future of Medicare Part C and D, ensuring that beneficiaries receive the best possible healthcare coverage.

1. Medicare Part C and D Plan Sponsors

Overview

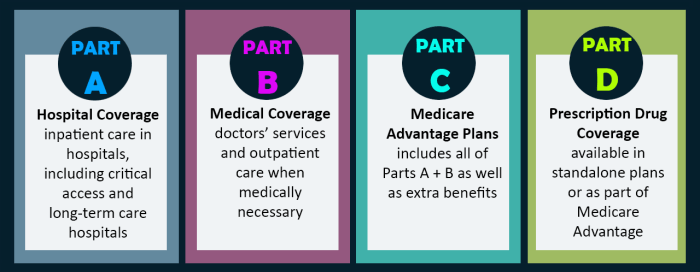

Medicare Part C and Part D plans are optional insurance plans that provide coverage for Medicare beneficiaries. Part C plans, also known as Medicare Advantage plans, offer comprehensive medical coverage, including hospital, medical, and prescription drug benefits. Part D plans provide prescription drug coverage only.

Sponsors play a vital role in administering these plans. They are responsible for designing and implementing the plans, ensuring compliance with Medicare regulations, and providing member services.

There are different types of sponsors involved in Medicare Part C and D plans, including insurance companies, healthcare providers, and non-profit organizations.

2. Responsibilities of Plan Sponsors

Plan sponsors have a number of key responsibilities, including:

- Ensuring plan compliance with Medicare regulations

- Developing and implementing marketing and enrollment strategies

- Providing member services and support

- Managing the plan’s finances

- Implementing quality assurance and improvement programs

3. Financial Management and Reporting, Medicare parts c and d plan sponsors

Plan sponsors are responsible for managing the plan’s finances. This includes setting premiums, collecting member payments, and paying claims.

Medicare pays Part C and D plans a fixed amount per member per month. The amount of payment is based on the plan’s benefits and the health status of its members.

Plan sponsors must submit regular reports to Medicare, including financial statements and data on member enrollment and utilization.

4. Member Services and Support

Plan sponsors are responsible for providing member services and support. This includes:

- Answering member questions

- Providing information about plan benefits and coverage

- Processing claims and appeals

- Helping members find providers

- Providing grievance and appeals procedures

5. Quality Assurance and Improvement

Plan sponsors are responsible for implementing quality assurance and improvement programs. This includes:

- Monitoring the quality of care provided by network providers

- Identifying and addressing areas for improvement

- Implementing quality improvement initiatives

6. Compliance and Regulatory Considerations

Plan sponsors must comply with all applicable Medicare regulations. This includes:

- Meeting minimum standards for plan benefits and coverage

- Providing accurate and timely information to members

- Protecting member privacy

Non-compliance can result in penalties, including fines and termination of the plan’s contract with Medicare.

7. Innovation and Future Trends

Plan sponsors are constantly innovating to improve the quality and efficiency of their plans. This includes:

- Developing new and innovative benefit designs

- Using technology to improve member services and care coordination

- Partnering with other organizations to provide integrated care

As the Medicare population continues to grow, plan sponsors will need to continue to innovate to meet the changing needs of their members.

Detailed FAQs: Medicare Parts C And D Plan Sponsors

What are the key responsibilities of Medicare Part C and D plan sponsors?

Plan sponsors are responsible for administering the plans, ensuring compliance with Medicare regulations, managing finances, providing member services, and implementing quality assurance programs.

How do plan sponsors ensure plan compliance with Medicare regulations?

Plan sponsors have a legal obligation to comply with all applicable Medicare regulations. They implement internal controls, conduct regular audits, and work closely with government agencies to ensure compliance.

What types of member services do plan sponsors offer?

Plan sponsors offer a range of member services, including customer support, claims processing, enrollment assistance, and disease management programs.