As accounting and financial ratios: expanding the vintage lily takes center stage, this opening passage beckons readers into a world crafted with authoritative knowledge, ensuring a reading experience that is both absorbing and distinctly original. The limitations of traditional ratios and the need for innovation in financial analysis set the stage for an exploration of new and groundbreaking approaches that promise to revolutionize the way we assess financial performance.

This discourse delves into the practical applications and use cases of these innovative ratios, demonstrating their ability to provide unparalleled insights into a company’s financial health and risk profile. Case studies and examples serve as illuminating illustrations, highlighting the benefits and challenges associated with their implementation.

1. Definition and Introduction

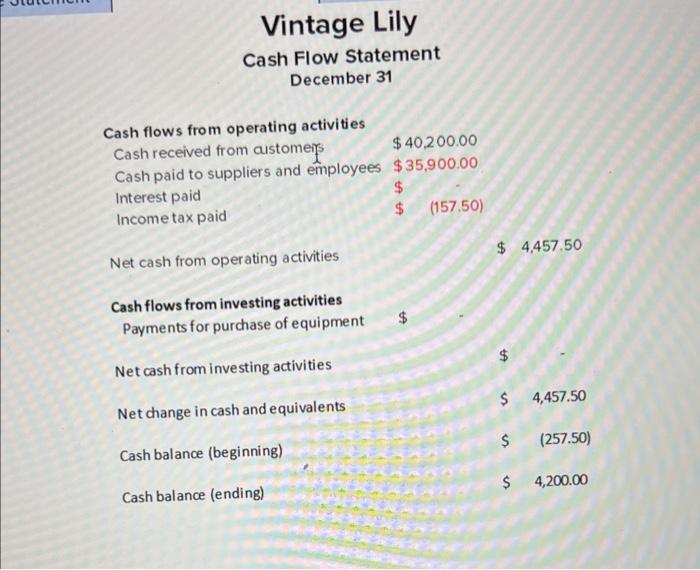

Financial ratios are a powerful tool used by analysts, investors, and other stakeholders to assess a company’s financial performance and risk profile. These ratios provide insights into a company’s liquidity, solvency, profitability, and efficiency. Understanding the concept of financial ratios and their historical use is crucial for effective financial analysis.

The use of financial ratios dates back centuries. Merchants and bankers have traditionally relied on ratios to evaluate the creditworthiness of borrowers. In the modern era, financial ratios have become an essential component of financial analysis, helping investors make informed decisions and companies identify areas for improvement.

2. Limitations of Traditional Ratios

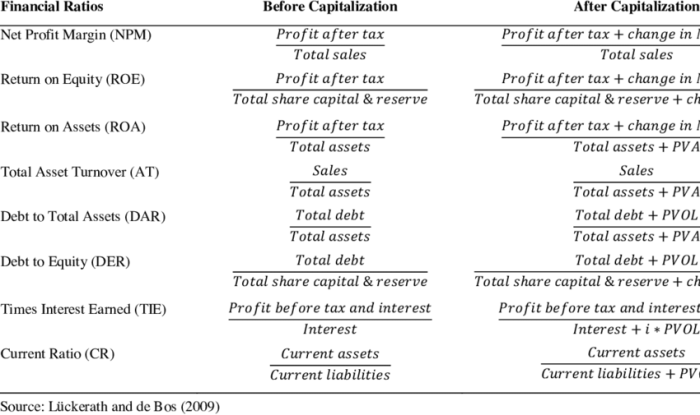

Traditional financial ratios, while valuable, have certain limitations. These ratios often rely on historical data, which may not always reflect a company’s current financial position. Additionally, traditional ratios can be misleading when applied to companies in different industries or with unique business models.

For example, the debt-to-equity ratio, a common measure of financial leverage, can be distorted by companies with significant intangible assets or operating leases. Similarly, the current ratio, a measure of short-term liquidity, may not accurately reflect a company’s ability to meet its obligations if it has a large amount of inventory that is difficult to sell.

3. Expanding the Vintage Lily

New and Innovative Ratios

To address the limitations of traditional ratios, researchers and practitioners have developed new and innovative ratios that provide a more comprehensive view of a company’s financial health. These ratios incorporate forward-looking data, industry-specific metrics, and other factors that may not be captured by traditional ratios.

Examples of new and innovative ratios include:

- Economic Value Added (EVA):A measure of a company’s true economic profit, which takes into account the cost of capital.

- Return on Invested Capital (ROIC):A measure of a company’s efficiency in using its invested capital.

- Sustainable Growth Rate (SGR):A measure of a company’s ability to grow without increasing its financial risk.

4. Applications and Use Cases

New and innovative financial ratios have a wide range of applications in financial analysis. These ratios can be used to:

- Assess a company’s financial performance relative to its peers and industry benchmarks.

- Identify areas for improvement in a company’s financial management.

- Make informed investment decisions by evaluating a company’s risk and return profile.

- Develop financial models and forecasts that incorporate forward-looking data.

5. Case Studies and Examples: Accounting And Financial Ratios: Expanding The Vintage Lily

New and innovative financial ratios have been successfully used in a variety of case studies and examples. For instance, a study by McKinsey & Company found that companies that use EVA as a performance measure outperformed their peers by an average of 10% per year over a five-year period.

Another study by the Harvard Business Review found that companies that use ROIC as a performance measure were more likely to achieve sustained growth and profitability.

6. Future Directions and Research

The field of accounting and financial ratios is constantly evolving. As new data sources and analytical techniques become available, researchers and practitioners are developing even more sophisticated and innovative ratios.

One promising area of research is the use of artificial intelligence (AI) and machine learning (ML) to develop new financial ratios. AI and ML can help to identify patterns and relationships in financial data that are difficult to detect using traditional methods.

FAQ Summary

What is the significance of expanding the vintage lily in accounting and financial ratios?

Expanding the vintage lily refers to the development of new and innovative financial ratios that address the limitations of traditional ratios. These new ratios provide a more comprehensive and nuanced assessment of a company’s financial performance and risk profile.

How can these innovative ratios be applied in practical financial analysis?

The new ratios can be applied in various practical settings, such as assessing a company’s liquidity, solvency, profitability, and operational efficiency. They can also be used to identify potential financial risks and opportunities.

What are some examples of these innovative ratios?

Examples of innovative ratios include the Altman Z-Score, the Piotroski F-Score, and the Beneish M-Score. These ratios incorporate a wider range of financial data and employ more sophisticated methodologies to provide a more accurate assessment of a company’s financial health.