Hires an administrative assistant journal entry – Hiring an administrative assistant is a crucial step for businesses of all sizes. It involves various accounting and tax implications that must be meticulously recorded and reported. This guide provides a comprehensive overview of the journal entry for hiring an administrative assistant, covering its structure, accounting principles, tax implications, internal controls, reporting and disclosure, and ethical considerations.

1. Journal Entry Structure: Hires An Administrative Assistant Journal Entry

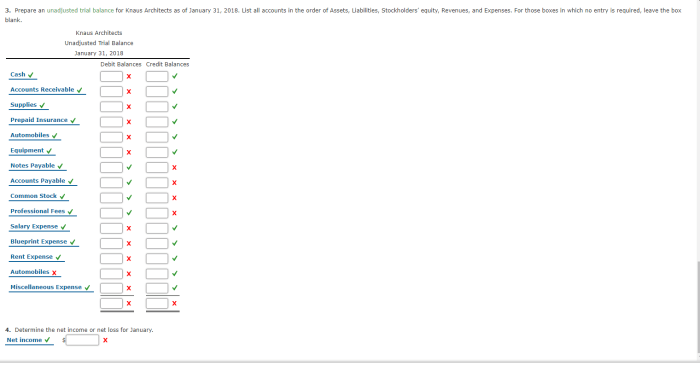

To record the hiring of an administrative assistant, a journal entry must be created following a standard format. The entry includes the following elements:

- Date of the transaction

- Account debited (e.g., Administrative Salaries Expense)

- Amount debited

- Account credited (e.g., Cash)

- Amount credited

For example, if an administrative assistant is hired at a monthly salary of $2,500, the journal entry would be:

- Debit Administrative Salaries Expense $2,500

- Credit Cash $2,500

It is crucial to record the transaction promptly to ensure accurate financial records and avoid any discrepancies.

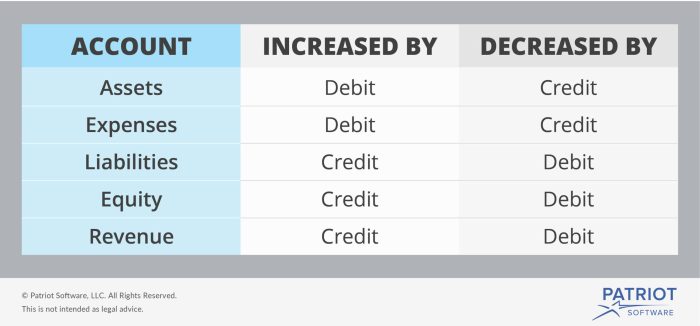

2. Accounting Principles

Several accounting principles govern the hiring of an administrative assistant:

Matching Principle

The matching principle requires expenses to be recognized in the same period as the revenue they generate. In this case, the administrative assistant’s salary expense is matched to the revenue earned during the period in which the assistant is employed.

Impact on Financial Statements

The transaction will impact the balance sheet and income statement as follows:

- Balance Sheet:The Cash account will decrease, while the Administrative Salaries Expense account will increase.

- Income Statement:The Administrative Salaries Expense will be reported as an expense, reducing the net income for the period.

3. Tax Implications

Hiring an administrative assistant has tax implications that must be considered:

- Income Tax:The assistant’s salary is subject to income tax, which must be withheld and paid to the relevant tax authorities.

- Payroll Taxes:Payroll taxes, such as Social Security and Medicare, must also be withheld from the assistant’s salary and paid to the government.

The exact tax liability will depend on factors such as the assistant’s salary, withholding allowances, and applicable tax rates.

4. Internal Controls

To prevent fraud and errors related to hiring an administrative assistant, internal controls should be implemented:

Segregation of Duties

Separate individuals should be responsible for hiring, payroll processing, and expense approval to minimize the risk of fraud.

Documentation, Hires an administrative assistant journal entry

Proper documentation, such as employment contracts, time sheets, and expense reports, should be maintained to provide evidence of the transaction and support accountability.

5. Reporting and Disclosure

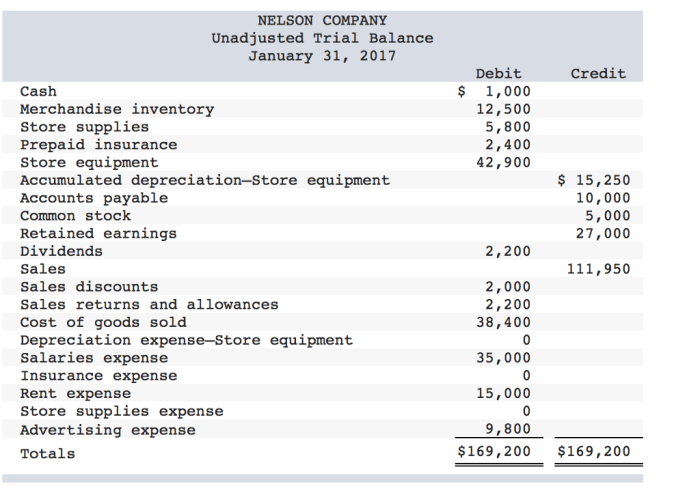

The journal entry for hiring an administrative assistant should be presented in an HTML table as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2023-03-01 | Administrative Salaries Expense | $2,500 | |

| 2023-03-01 | Cash | $2,500 |

Financial reporting and disclosure are essential for providing transparency and accountability. The transaction may be disclosed in the company’s financial statements, such as the balance sheet, income statement, or notes to financial statements.

6. Ethical Considerations

Ethical considerations are paramount when hiring an administrative assistant:

Fair Treatment

Employees must be treated fairly and equitably, regardless of their position or status.

Confidentiality and Privacy

The assistant may have access to sensitive information, so it is crucial to maintain confidentiality and respect their privacy.

FAQ Compilation

What is the standard format of a journal entry for hiring an administrative assistant?

Debit: Administrative Assistant Salary Expense, Credit: Cash or Accounts Payable

What are the accounting principles that apply to hiring an administrative assistant?

Matching principle, accrual principle, and going concern principle

What are the tax implications of hiring an administrative assistant?

Payroll taxes, income taxes, and unemployment insurance